Donald J. Trump strode back into the White House on January 20, 2025, and immediately began rearranging the world. He signed 26 executive orders on his first day in office, more than any other president in history. One of those executive orders was to rename the Gulf of Mexico.

That means the Caribbean Sea, home of the island paradise of Curacao, is no longer connected to the Gulf of Mexico. Now the Caribbean Sea flows into the Gulf of America. And that’s just for starters.

The Republic of Colombia’s northern border is the Caribbean Sea. The country is one of America’s closest allies. Less than a week into his presidency, Trump sent two US planes carrying deported migrants to Colombia. Colombia refused to let them land because the planes were military, not civilian. Trump immediately said he would impose 25% tariffs and a travel ban, and evoke the visas of Colombian government officials. Hours later, Colombia backed down.

In short, after Trump’s first week in office, one thing we can count on is more surprises.

The luxury real estate market in the Caribbean has long been an attractive destination for investors seeking high-end properties, whether for personal use, rental income, or as a hedge against economic fluctuations. The presidency of Donald Trump, known for his real estate background and dramatic impact on US and global economic policies, could have significant effects on this complicated market.

Let’s break it down.

The Caribbean isn’t just one country or island. It’s a region made up of many islands, archipelagos, and countries surrounding the Caribbean Sea.

Starting in the 16th century, various European powers sailed into the Caribbean and colonized different islands. They left a complex legacy of language, culture, and legal systems that vary from island to island.

The Kingdom of the Netherlands

The Kingdom of the Netherlands is made up of four countries. On the European continent, there is the country called the Netherlands. The other three countries — Aruba, Curacao, and Sint Maarten — are far across the Atlantic Ocean in the Caribbean Sea.

Make America First

Trump often complains about the US trade deficit with the European Union. But not with the Kingdom of the Netherlands. In 2023, the United States exported $116.9 billion in goods and services to the Netherlands, while importing $54.4 billion. The US trade surplus with the Dutch was $62.5 billion. That makes the Netherlands America’s trading partner with the highest trading surplus.

Curacao is a Caribbean island country with its own constitution. It relies on the Kingdom of the Netherlands for foreign policy and defense but has significant autonomy.

Today, Curacao delivers a vibrant culture and a burgeoning tourism industry. It has world-class beaches with snorkeling and scuba diving right off the shore. Colorful Dutch architecture and historic museums reflect the unique character of Willemstad, its capital and UNESCO World Heritage site.

Curacao ports are vital for the island’s economy, handling both cargo and cruise ships with Dutch expertise. Curacao is also a financial center, with low taxes that attract international businesses.

Curacao is south of the Caribbean hurricane belt and is rarely threatened. The Curacao International Airport (CUR) connects the island to major cities all over the globe, including a daily nonstop flight from Amsterdam. There are no restrictions on foreign buyers acquiring real estate in Curacao.

Residents of Curacao can apply for Dutch citizenship after living there for five years as part of the Investor Permit Program with a minimum investment of $280,000. Dutch citizenship opens up a whole other world. You get European Union citizenship benefits, including the right to live and work anywhere in the EU. It offers an alternative for US citizens and other globetrotters who could use another passport — no matter who is in the White House.

Trump’s reelection promises policy continuity, focusing on deregulation, tax reforms, and pro-business initiatives. For Curacao, this could mean enhanced investment opportunities.

Continued or expanded tax incentives similar to those seen in the US like pass-through deductions and like-kind exchanges might encourage more American investors to look towards Curacao. The island’s stable economy and Dutch legal system make it attractive for those looking to leverage such benefits outside the US.

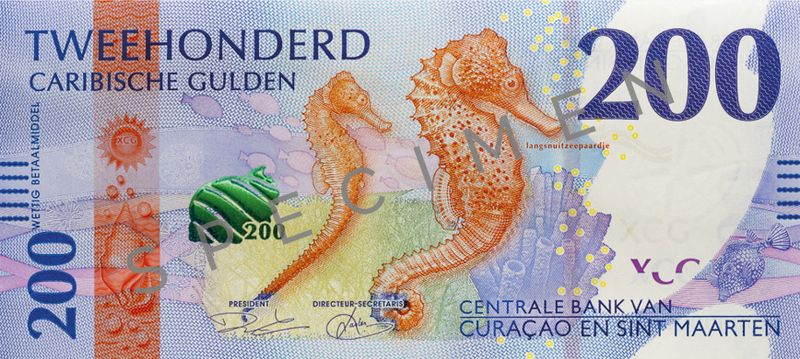

Until recently, Curacao used the Netherlands Antillean Guilder (ANG), pegged to the US dollar at approximately 1.79 to 1 USD.

The new currency, the Caribbean Guilder (XCG), is set to replace the ANG on March 31, 2025. Only two countries will use the XCG: Curacao and Sint Maarten, the Dutch side of the island of Saint Martin (the other side is French). The new currency represents a step towards a distinct cultural identity for Curacao and Sint Maarten.

Donald Trump’s presidency could influence the Caribbean guilder in several speculative ways:

Donald Trump’s presidency could stimulate investor behavior in the Caribbean luxury real estate market through a complex web, including:

While some investors might see opportunities in a robust US economy or favorable tax policies, others might be wary of the political and economic volatility that could accompany his administration.

The Caribbean, known for its allure as a luxury haven, must navigate these influences carefully to maintain or grow its appeal among the global elite looking for prime real estate investments.

At Palmstone Real Estate, we can guide you through the elements that make investing in Curacao an intriguing prospect. Contact us if you want to diversify your portfolio in a market that combines luxury with a stable, welcoming environment.